Bookkeeping Checklist for Small Businesses

As a small business owner, you have a lot on your plate. Not only are you the CEO, you’re also the head of marketing, finance, sales, customer service, and human resources. With so many responsibilities to juggle, it’s easy to let bookkeeping fall to the wayside.

And that’s understandable—to an extent. After all, there are only so many hours in the day. Each of us has to prioritize our tasks based on what is most important.

The problem is that most small business owners place bookkeeping towards the bottom of the priority list when it should be near the top. Think about it: if the ultimate goal of running a business is to make money, then shouldn’t you actively monitor your company’s finances?

That being said, knowing that you should stay on top of your bookkeeping and actually staying on top of it are two different things. To help hold you accountable, we’ve created a bookkeeping checklist that will help you stay on track throughout the year.

Small Business Bookkeeping Checklist

They say the secret to accomplishing a big goal is to break it down into small, actionable steps. As professional accountants, we agree with this sentiment—especially when it comes to bookkeeping!

When you look at all the tasks associated with bookkeeping as a whole, it’s completely overwhelming (which is part of the reason people procrastinate and fall behind on it). However, once you break it down into smaller, more manageable chunks, you’ll see that it’s really not so bad.

That’s what we did here. Below, you’ll find our small business bookkeeping checklist broken down into daily, weekly, monthly, quarterly, and annual tasks. That way, you’re not overloaded with an entire laundry list of to-dos.

Daily Bookkeeping

Check Your Account Balance

Good bookkeeping starts with good habits, and the very first habit you should develop is checking your business bank account balance every morning. It’s important to know how much cash you have available should any unexpected expenses pop up.

Keep an Eye on Incoming & Outgoing Payments

Keeping track of the comings and goings of your money is another habit you’ll want to incorporate into your daily routine. Doing so will prevent you from overdrawing your account.

Weekly Bookkeeping

Prepare & Send Customer Invoices

It’s easy to lose track of customer invoices when you don’t have a set schedule for sending them. Carving out a specific time each week to complete this task will help you keep tabs on who owes what.

Review & Update Payroll

Regardless of how often your employees are paid, you should review and update your payroll file on a weekly basis so you can account for fluctuations, like bonuses or overtime pay.

Assess Your Cash Flow

As a business owner, your goal is to generate positive cash flow. Each week, you should check-in with yourself to assess how well you’re performing in this regard. You should also try to forecast what your cash flow will look like for the following week.

Monthly Bookkeeping

Follow Up on Unpaid Invoices

Review any unpaid invoices and decide what action to take from there. In most cases, a simple reminder email or phone call will do the trick. In other cases, it might be time to contact a collections agency.

Pay State Income Taxes

If you’re doing business in a state with an income tax, you’ll need to pay these taxes every month. Note that the amount and procedure for doing so differs from state to state. When in doubt, consult with a tax professional.

Reconcile Your Bank Accounts

Don’t get lazy on this one! While the process of matching your bank balance to your bookkeeping records may be cumbersome, it’s an important protocol that will help you spot any errors or fraud.

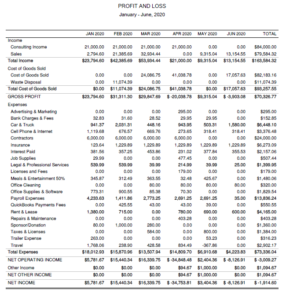

Calculate Your Profit and Loss

Are you making money or losing money, and by how much? You won’t know until you calculate your profit and loss.

When computing your profit and loss, you’ll want to do so on both an individual level (meaning for each product you sell) and for your business as a whole.

To determine the profit and loss of each individual product, use the following formula:

Unit selling price – unit cost price = profit if positive, loss if negative

To determine the profit and loss for your business as a whole, use this formula:

total revenue – total expenses = profit if positive, loss if negative

In the accounting world, we call this a profit and loss (P&L) statement:

You should review these figures on a monthly basis at minimum so you can resolve any issues in a timely manner.

Quarterly Bookkeeping

File State and Federal Income Tax Forms

While not all businesses are required to file a state income tax form, all small businesses with one or more employees (including if that one employee is also the owner!) are required to file Form 941, Employer’s Quarterly Federal Tax Return. This document reports the amount of income taxes, social security tax, and Medicare tax withheld from the employee’s paychecks. If you’re not sure how to fill out the form, don’t sweat it; this is something your payroll provider can easily assist you with.

State income tax forms, on the other hand, are a little more nuanced. If you do business in a region with a state income tax, we highly suggest consulting with an accountant.

Issue Earnings

Depending on your business entity type, you may want to payout quarterly dividends or take distributions.

Annual Bookkeeping

Count Your Year-End Inventory

This one is pretty straight forward. Take stock of what you currently have on hand so you know exactly how much product you have available and the cash value of that inventory.

Finalize Your Reports

Before you close out your books for the year, double check that all your financials are in order. Using the information you have on file, compile a year-end balance sheet, P&L statement, and cash flow statement.

File Essential Forms

Forms, forms, forms, and more forms! Yes, in addition to all the tax forms you’ve already filed, you’ll need to file some annual ones as well.

One of the benefits of using a payroll provider is that they will handle any 1099-MISC forms or W-2s, so you’re covered on that front. However, you will also need to file business income taxes, which will require you to submit either an IRS Form 1120 or an IRS Form 1120S. And then of course there’s your personal income tax return, which is a separate beast all together.

Given how tricky taxes can be, we always recommend hiring a professional to ensure everything is done properly.

Conclusion

Now that you’ve read our small business bookkeeping checklist, it’s time to be honest with yourself: do you see yourself sticking to this regimen? Because if not, you’re better off outsourcing your bookkeeping to a virtual accounting firm like ours. With flat-rate prices starting at just $199/mo, you’ll likely find that it’s faster, easier, and cheaper to hire a professional.

Before you go, we want to present you with a special offer for reading our article. For a limited time only, we’re offering a complimentary consultation plus three FREE months of QuickBooks Online when you sign up for our services. To unlock this offer, simply enter your name and email address in the contact form below and we’ll be in touch shortly to schedule your free consultation.