Customer Lifetime Value: How it Works

As a business owner, making data-driven decisions is key to succeeding in the modern age. Whether generating more web traffic or growing your social media following, having the correct information can help narrow the path toward your goals. One metric you need to track is Customer Lifetime Value (CLV), an indicator of how valuable a buyer is to your brand.

Tracking CLV can improve customer retention rates and highlight opportunities to generate more sales revenue. This article will discuss how customer lifetime value works and how you can calculate it to help you take full advantage of the data available.

Why is customer lifetime value important?

Customer lifetime value plays a crucial role in helping to maximize the profits you earn from each buyer. Statistics show that the selling probability for existing customers is around 60-70%, while the selling probability for new customers is at 5-20%. This means that businesses have more opportunities to generate sales when they take care of their customers, and this is where customer lifetime value comes in.

By understanding how much each customer brings in revenue to your business, you can optimize their shopping experience to boost sales figures and maintain stronger relationships. Moreover, customer lifetime value can help answer the following questions for your brand:

- How much should you spend to retain your customers?

- Which products are the most profitable for your business?

- Which strategies should you employ to nurture existing customers?

Ultimately, CLV can aid in making business decisions and developing strategies to encourage existing customers to support your brand regularly.

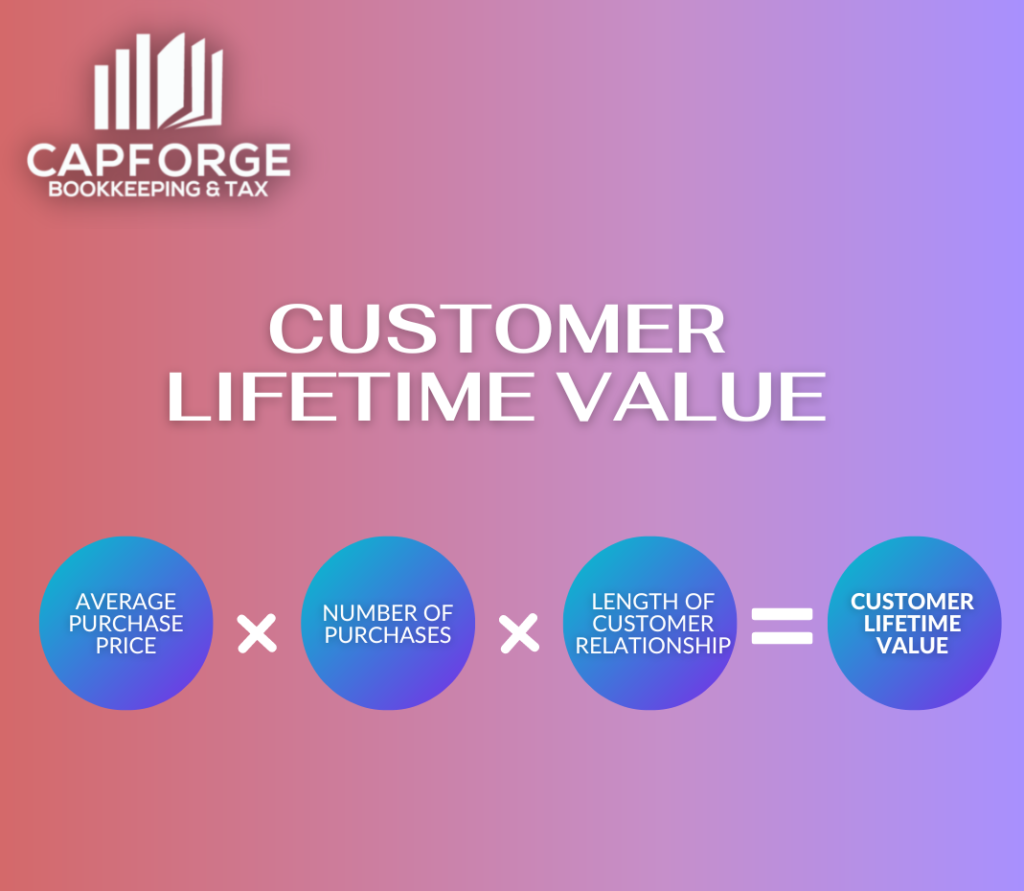

How do you calculate customer lifetime value?

There are many ways to calculate customer value, ranging from complex methods to simplified number-crunching. The easiest way to calculate CLV is to determine the customer’s average transaction value, multiply it by the number of transactions per year, and then multiply the customer’s relationship in years.

Say a customer buys jeans regularly from a clothing store. An example of calculating CLV would look something like this:

($200 per pair of jeans) x (4 pairs per year) x (5 years of customer relationship) = $4,000 CLV.

Another example is when a person buys hoodies from the same store. The calculations go like this:

($150 per hoodie) x (6 hoodies per year) x (4 years of customer relationship) = $3,600 CLV.

Notice how the two examples have nearly identical customer lifetime values. So, what does the CLV indicate for the clothing store? It means both products are highly profitable and play a crucial role in generating cash flow for the store.

As the customer relationship matures, you want to keep an eye on the CLV and see if the numbers are rising or falling. If the numbers are increasing, you’re doing a great job of providing an excellent shopping experience. If the numbers are decreasing, you need to make adjustments, whether offering new hoodie designs or updated jean fits.

How do you increase customer lifetime value?

Investing in your current customer base is always a good idea, mainly because of the potential for more revenue. If you’re looking to increase customer lifetime value, here are a couple of ways to achieve it:

1. Implement a referral program

One of the best ways to boost CLV is by offering referral programs. You attract high-quality customers at lower acquisition costs, which is great for building long-term customer relationships. Trust recommendations prove valuable for people who are unfamiliar with your brand, as the referrer has hands-on experience with your products/services.

A good referral program incentivizes your existing customer base while opening up doors for new ones. When done correctly, it can increase the customer lifetime value and generate more sales for your business.

2. Listen to customer feedback

If you want to build a loyal customer base, you have to put their needs first. Getting a pulse from your customers is essential to know their level of satisfaction, and you can do this through forms, surveys, and reviews.

Ask your customers on a scale of 1-10 how satisfied they are with your service. Are they willing to recommend your products to their friends and family? If not, what are the ways you can rectify the issue to improve their satisfaction levels?

You can also leave a short comment section on your surveys to allow customers to provide additional information. Gather as much data as possible from your customers, and use that to optimize their browsing and shopping experience.

3. Reward your most loyal customers

Everybody loves rewards, including your die-hard customers that continually support your brand. To show appreciation for their unwavering loyalty, you can create a rewards system that incentivizes your customers and make them feel valued by your business.

Loyalty programs are an excellent strategy for boosting CLV as it turns your most loyal customers into brand ambassadors. You can offer point-based systems that customers can redeem for discount codes and merch, or you can create a tier-based program where customers can level up and get rewards.

No matter how you set up your loyalty program, there’s no denying its effectiveness in increasing customer lifetime value and fostering brand loyalty.

4. Elevate your marketing strategies

The thing about customer lifetime value is that it’s not an invariable metric, meaning it changes depending on how customers feel about your brand. When planning your marketing strategies, you want your content to resonate with your target audience. One way to achieve this is by leveraging social media marketing and influencer marketing.

The power of influence has never been more evident in this digital age, where influencers are capable of driving sales and reinforcing trust in your business. You can elevate your marketing tactics through influencer marketing, a method proven to drive sales and repeat business to your target audience.

You can learn more about influencer marketing by reading our article here

5. Use cross-selling to your advantage

Once you’ve built a loyal customer base, you can offer them more value by implementing cross-selling techniques. When done correctly, cross-selling provides additional revenue by offering better solutions to your customers. For example, if a customer buys a powder blush from a beauty store, the owner can cross-sell the transaction with a lip primer or a facial toner.

Remember, cross-selling shouldn’t feel like it’s forced upon the customer. Rather, it should feel like a value purchase that adds to the experience of buying your products. By doing so, you can increase customer lifetime value and get the most out of your loyal customers.

Wrapping up

Tracking customer lifetime value brings plenty of advantages to your business. It helps you identify profitable products, maximize the value of each customer relationship, and even acquire new customers. Use the information in this article to calculate CLV and increase its value over time.

Does your business need help with sorting out its financial records? If so, our team is here to help! Simply fill out the form below, and we’ll get in touch with you shortly.