Filing 1099s for 2024- Who Gets One?

It’s 1099 time of year again! But what does that mean and who should pay attention? Read on to find out!

CapForge 1099 Procedures

- Enter recipient information and 1099 amounts in the portal and click Approve for each one (we won’t file 1099s without your approval!)

- We file your 1099s, and recipients receive a copy via USPS

- PDF copies will be available for you to access in your Client Portal under My Documents

Learn More About 1099s

There are a bunch of 1099 form types (some of them rarely used), so we will focus on the three most commonly used 1099 form types. But let’s start with some general rules:

The first thing to do in the 1099 filing process is to get a W9 from your vendors and contractors. Why? The information on that form (namely the entity type portion) is going to determine whether you need to file at all. Plus, without this information, you won’t have all the information you need to file anyway! If you have their info from a previous year, you don’t need to get a new one each year unless they had a change of address or business name since you got the last copy from them.

Who Gets a 1099?

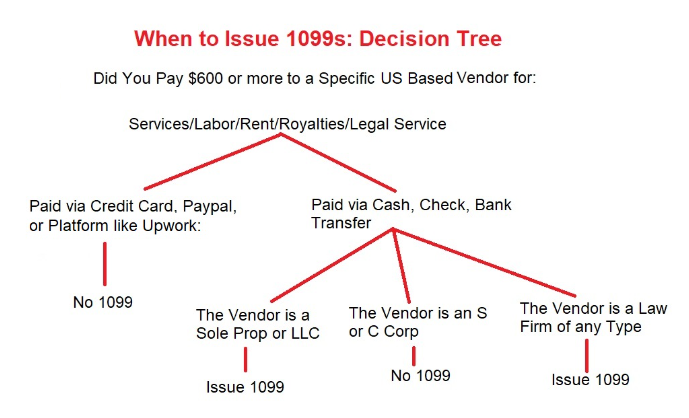

In general, you don’t have to issue 1099 forms to C-Corporations and S-Corporations.

It’s a common belief that businesses don’t need to send out 1099 forms to corporations. And this is true…mostly.

In general, you don’t have to issue 1099 forms to C Corporations and S Corporations. But there are some exceptions, including:

- Medical and health care payments

- Payments to an attorney

- Substitute payments in lieu of dividends or tax-exempt interest

You contract with a business that is an LLC sole proprietorship.

You will need to send out a 1099-NEC form if you’re working with an LLC sole proprietorship. An easy way to tell? Just look at the W-9 the worker provided. If the W-9 indicates they are an LLC that is taxed as a sole proprietorship, you need to send a 1099. If their LLC is taxed as an S- or a C-Corp you do not (unless an exception applies as described above).

They are in the US

1099s are reported for US tax payers, so none of this applies if you are talking about contractors who are outside the US and not US citizens or tax payers, which is often the bulk of outsourced service providers these days.

You are paying them directly.

If you pay them via a check, cash, or other direct payment (such as Paypal, Zelle, or Venmo) then you would need to issue them a 1099. If you paid them via a credit card, then they will not need one as their merchant account (their credit card processor) will issue them one. Same thing if you hired a freelancer through a service like Fiverr or Upwork- those platforms will issue a 1099 for ALL the payments that contractor received through the platform, so if you issue one as well, their income will be double counted.

Does all this sound confusing? It can be. But we can help. Let us know who you aren’t sure about and we can help you tell if you need to issue one or not.

1099 Form Types

1099 NEC: The 1099-NEC is the form that will be needed to report independent contractor payments of $600 or more in the 2024 calendar year. NEC stands for Non-Employee Compensation and Form 1099-NEC is taking the place of what used to be recorded in Box 7 of Form 1099-MISC up until the last couple of years

So who gets a 1099-NEC? Typically, this form is issued to independent contractors, janitorial services, third-party accounts and any other worker paid for services who is not on your payroll and not your employee.

Here is a handy guide to start with on who gets one, and then we can dive into the details:

But let’s look at the details, since they do matter!

The payment is $600 or more for services—not physical products.

The first rule of thumb is that the total of the payments for the year must be at least $600. If it’s less than that amount, a 1099-NEC is not required and should not be issued. If part of the payment was for materials, software subscriptions or other things that aren’t direct labor then that amount is not included in the 1099 amount reported.

Services performed are for business purposes.

Say you contract with a worker to remodel your office break room. The total comes to $5,000. You would likely issue a 1099-NEC in this case. But let’s say you contracted that same worker to remodel the kitchen in your home. Do you need to issue a 1099-NEC? The answer is no, because the kitchen remodeling was for personal, not business reasons.

What about the other form types?

At least 95% of the forms we file are 1099 NEC forms for contractor payments. A couple other (slightly less common) forms that you can choose in our online portal:

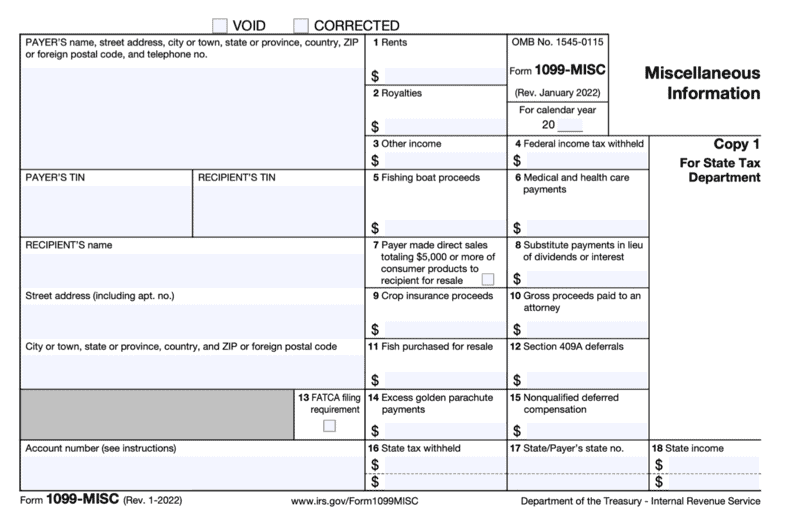

1099 MISC is most commonly used for Rent payments, if you paid $600 or more in 2024. Our online submission for 1099 MISC defaults to filing for rent payments so you can let your bookkeeper know if you are using the 1099 MISC for something other than rent (medical payments, payments as part of a legal settlement, royalties, prizes, etc).

1099 INT for interest paid; what is notable about this form is the low payment threshold…you should file if you paid someone $10 or more in interest for the year.

Deadlines and Penalties

You will need to send out a 1099-NEC form if you’re working with an LLC sole proprietorship. An easy way to tell? Just look at the W-9 the worker provided. If the W-9 indicates they are an LLC that is taxed as a sole proprietorship, you need to send a 1099. If their LLC is taxed as an S- or a C-Corp you do not (unless an exception applies as described above).

The deadline for filing is January 31. If this day falls on a weekend then it is the following Monday. In theory, if you file late, you can get a late filing penalty, although over the years I have yet to ever see a client get one. So while you should file on time, if you miss a few or miss the deadline by a couple days, don’t panic. My suggestion is to file, even if you are late- better to file late than never.

What’s the risk of not filing? The 1099 is your “receipt” that you in fact paid someone for services and didn’t just make up some expenses to lower your tax bill. If you don’t file the 1099 and the IRS decides to audit your expenses, it’s possible you could be responsible for paying taxes on the amount that you didn’t report. It doesn’t happen often, but you don’t want to be in the position of paying more tax than you should because you didn’t file that simple little form!

If you have questions or need help filing this year, just let us know!