How to Find The Best Bookkeeping Services in Carlsbad

Running a small business takes a lot of work. But you know what’s even harder? Managing your finances while trying to fulfill multiple roles. At some point, you’ll have to seek help to make sure your small business is heading in the right direction. If you’re looking for the best bookkeeping services in Carlsbad, you came to the right place!

Accurate bookkeeping is the foundation of good financial management, and for small businesses, it’s important you have a solid understanding of what your finances look like. This will help you make sound budgeting and forecasting decisions to help your business grow in the long term.

Let’s discuss what you need to look for in a bookkeeping firm to help choose the right service for your business.

Signs You Need Help With Your Small Business Bookkeeping

It’s not uncommon for small business owners to be somewhat hands-off with their bookkeeping practices. And while it may not lead to severe financial consequences at the beginning, it will rear its ugly head as you try to scale your business.

Here are some indicators that tell you need help with your small business bookkeeping:

Financial Records Are Inconsistent or Incomplete

When financial records don’t match up or lack detail, this signals that a business might need help with its bookkeeping. If transactions are missing, incorrectly recorded, or don’t align with bank statements, it becomes difficult to assess the company’s financial health.

Incomplete or inconsistent records often lead to problems when tax season arrives or when the business seeks loans. Regularly reviewing these records should not feel like a guessing game. When it does, it’s a clear sign that professional assistance could prevent future headaches.

Cash Flow Problems Persist

Cash flow issues are another sign that bookkeeping support might be necessary. If a business struggles to track its income and expenses, it may experience ongoing cash shortages or an inability to predict financial needs. Businesses that can’t easily pinpoint where their money is going or when it will run out are at risk. Understanding cash flow is crucial for making informed decisions, such as when to make a large purchase or whether it’s feasible to hire additional staff.

Falling Behind on Invoicing and Bill Payments

Timely invoicing and bill payments keep the business running smoothly. If a business often forgets to send invoices or pays bills late, it may suffer from a lack of organization in its bookkeeping processes.

These delays can hurt relationships with clients and lead to late fees or lost income.

Difficulty Preparing Financial Reports

Preparing accurate financial reports requires detailed knowledge of the business’s financial activities.

When a small business owner finds it challenging to create reports like profit and loss statements, balance sheets, or cash flow statements, it might indicate a need for bookkeeping help.

Constant Worry About Taxes

Small business owners who constantly stress about tax time may need bookkeeping assistance. Taxes require careful tracking of income, expenses, and deductions throughout the year.

If a business doesn’t have a solid system in place, tax season can become overwhelming. Incorrect filings or missed deductions could lead to penalties or missed opportunities for savings.

Things to Consider When Choosing a Bookkeeping Firm

Choosing a bookkeeping firm to entrust your financial documents is not an easy choice. You want to work with a firm that’s professional and trustworthy enough to optimize your bookkeeping practices.

Before you outsource your bookkeeping, here are a couple of things you should consider:

- Industry expertise: Businesses should first look for a bookkeeping firm with strong experience in their industry. Different industries have unique financial needs. Retailers deal with inventory management, while service providers focus on time tracking and billing. A firm familiar with your industry will understand these nuances and help you make informed decisions.

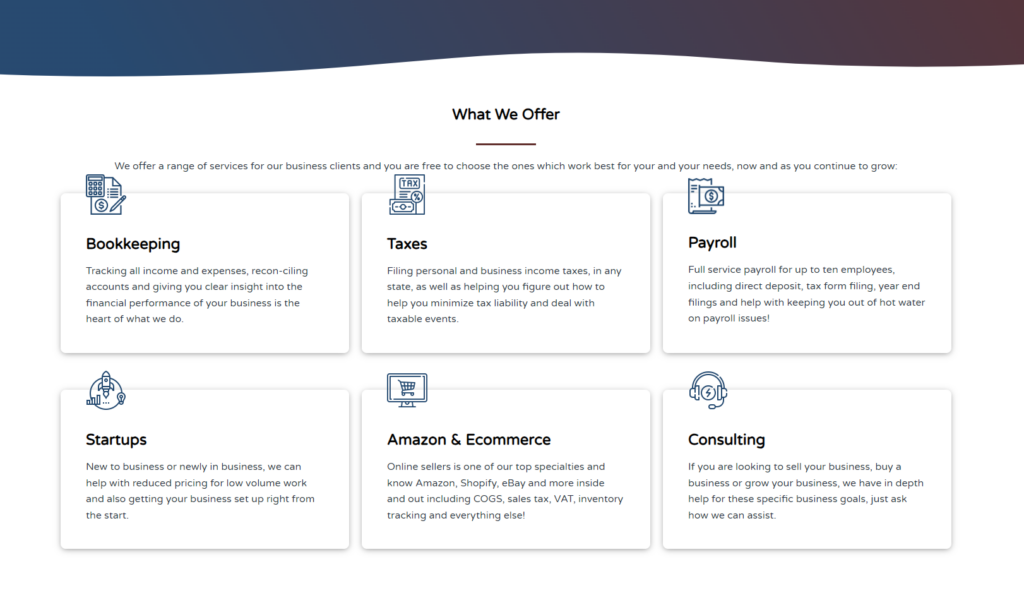

- Range of Services: Choose a firm that offers a variety of services that match your needs. Bookkeeping firms differ in their offerings. Some focus only on basic bookkeeping, while others provide payroll services, tax preparation, and financial reporting.

Understanding what you need now and what you might need in the future will help you make a better choice.

- Communication and accessibility: Good communication is key in any professional relationship. Ensure that the firm you choose is accessible when you need them. Regular updates on your financials and prompt responses to your queries are signs of a firm that values your business.

Avoid firms that leave you in the dark or take too long to respond.

- Access to the latest technology: The tools a bookkeeping firm uses can make a difference in how smoothly your financial processes run. Look for firms that use up-to-date software compatible with your systems.

This helps avoid unnecessary complications. Also, ask about their backup and data security practices to protect your financial information.

- Cost and transparency: Costs vary widely among bookkeeping firms. It’s important to understand their fee structure upfront. Some firms charge hourly rates, while others offer flat fees.

Ask for a clear breakdown of what you’re paying for. This will help you avoid surprises later and choose a firm that fits within your budget.

- References and reviews: Finally, check the firm’s reputation before making a decision. Ask for references from other small business owners and read online reviews. A good bookkeeping firm will have satisfied clients who are willing to vouch for them.

Take the time to do this research as it can provide valuable insights into what you can expect.

Why CapForge Offers The Best Bookkeeping Services in Carlsbad

Here at CapForge, we do bookkeeping differently than most bookkeeping firms out there. We treat every small business with the utmost care and consideration, as we believe their needs are quite diverse.

Here are five reasons why you should entrust your small business bookkeeping to us:

1. Expertise and Experience

CapForge is a top choice for bookkeeping services in Carlsbad due to our extensive expertise and experience. Founded in 2000, CapForge has over two decades of experience in the field, which is invaluable when handling the diverse needs of small and medium-sized businesses.

Matt Remuzzi, the owner, is a Diamond Level QuickBooks Certified ProAdvisor, a credential that highlights the deep knowledge and proficiency our company offers. Thousands of businesses have benefitted from our services which reflects the trust and reliability CapForge has built over the years.

2. Transparent Pricing with No Hidden Costs

One of the most attractive aspects of CapForge is our commitment to transparent pricing. Clients know exactly what they will be paying upfront, with no surprises or hidden fees.

Unlike many competitors who charge by the hour, CapForge offers fixed rates, which eliminates any concerns about inflated billing due to inefficient work.

3. Personalized Service and Scalability

CapForge excels in offering personalized bookkeeping solutions tailored to each client’s unique needs. Whether a business is just starting out or experiencing rapid growth, our services can easily adapt to meet your growing demands.

CapForge ensures that our client’s bookkeeping needs are met efficiently, allowing you to focus more on core business activities.

4. Commitment to Security and Data Integrity

Security is a top priority at CapForge, which makes us a preferred choice for businesses concerned about the safety of their financial data. We employ robust security measures to protect client information, including limited access protocols and secure server systems.

CapForge underscores its dedication to maintaining the highest standards of data protection for your peace of mind.

5. Customer-Centric Approach

CapForge emphasizes a customer-first approach in every aspect of our service. We foster open communication with our clients, offering regular updates and encouraging feedback to ensure that our services continually meet client expectations.

We will gladly answer questions without additional charges and our month-to-month contract options demonstrate our commitment to client satisfaction.

Get Started Today With CapForge’s Bookkeeping & Tax Services

Take control of your business finances with CapForge. Our expert team makes managing your bookkeeping simple, so you can focus on what really matters—growing your business.

Partner with us today and discover the peace of mind that comes from knowing your financials are in good hands.

Send an email to info@capforge.com or contact us at 1-858-633-3573 to get started. Additionally, you can fill out the form below and we’ll be happy to attend to your needs!

FAQ About The Best Bookkeeping Services in Carlsbad

How much do bookkeeping services cost in Carlsbad?

The cost depends on a variety of factors like the size of your business and the complexity of your financials. Check out our pricing options for more information.

What should I look for in a top-notch bookkeeping service?

Look for services that handle all your financial needs, including record-keeping, payroll, tax prep, and financial reporting. The best services will customize their offerings to fit your business, using up-to-date accounting tools.

How can a bookkeeping service help my business grow?

Accurate records and timely financial reports give you a clear view of your cash flow. This helps you make informed decisions that can lead to better business health and growth.